If you’ve ever applied for a credit card and been denied, don’t worry-you’re not alone. In fact, about 1 in 4 credit card applications are denied. The good news is that there are usually several reasons why your application may have been declined, and most of them are relatively easy to fix. In this blog post, we will discuss the most common reasons why applications are denied, and how to remedy them!

One common reason for denial is having insufficient credit history. If you don’t have much experience with borrowing and repaying loans, lenders may be hesitant to approve your application. However, there are plenty of ways to build up your credit history, such as taking out a small personal loan or using a secured credit card.

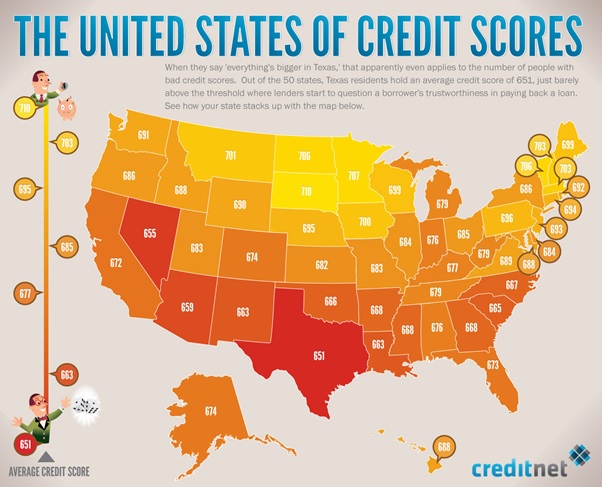

Another common reason for denial is having a low credit score. If your score is below 700, it may be difficult to get approved for a traditional credit card. However, there are plenty of options for people with bad or no credit, such as no credit check loans online instant approval. Whatever the reason for your denial, there is likely a solution!

In this blog post, we will discuss the most common reasons why applications are denied, and how to remedy them!

It’s a Good Idea to Wait Before Reapplying

One of the most common reasons why credit card applications are denied is because the applicant has too many recent inquiries on their credit report.

According to a recent study, one of the most common reasons why credit card applications are denied is because the applicant has too many recent inquiries on their credit report. The study found that 21% of applicants who were denied a credit card had six or more inquiries on their report in the past six months. In contrast, only 8% of those who were approved for a credit card had that many inquiries.

This difference is significant because inquiries can have a negative impact on credit scores. Therefore, it’s important to be mindful of how many times you apply for credit in a short period of time. If you’re planning on applying for a new credit card, it’s best to wait until your report is clean of any recent inquiries.

When you apply for a new credit card, the issuer will almost always do a hard pull on your credit report-which can temporarily lower your score by a few points. If you have applied for several cards in a short period of time, this can make it look like you’re desperate for credit-which is a red flag to issuers.

The best way to fix this issue is simply to wait before reapplying. After a few months have passed, your inquiries will no longer be counted against you and your score will likely rebound. In the meantime, you can focus on using the credit cards you already have responsibly to help improve your score.

Read Your Adverse Action Letter

The credit card company has up to 30 days to accept or deny your application, but you should hear from them in a few weeks. If you receive a denial notification, it will generally include the reason or reasons for your credit card application’s rejection.

It could be related to something on your credit report, recent late payments, or high credit card balances, for example. In that case, you’re entitled to a free copy of your credit report to make sure the information in it is accurate.

If you were denied because of your credit score, the credit card issuer would send a copy of the credit score and the top factors contributing to your credit score.

You could also be denied for a reason unrelated to your credit, like your income, employment history, or if you’re under 18, as long as these reasons are not considered discriminatory.

Request Your Free Credit Report

If you’re not sure why your credit card application was denied, the best place to start is by requesting a free copy of your credit report. This will give you a good idea of where your credit stands and what, if anything, needs to be improved. You’re entitled to one free credit report from each of the three major credit bureaus-Experian, Equifax, and TransUnion-every year.

You can request your free credit report online at AnnualCreditReport.com. Once you have your report, review it carefully to look for any errors or negative items that could be dragging down your score. If you find anything that doesn’t look right, you can dispute it with the credit bureau.

Review Your Free Credit Score

In addition to your free credit report, you can also check your free credit score to get an idea of where you stand. Your credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay debt. The higher your score, the more likely you are to be approved for a new credit card.

There are a number of ways to check your credit score for free. Many credit card issuers now offer free credit scores to their customers, and there are also several websites that provide free credit scores, like Credit Karma and NerdWallet.

If you find that your credit score is low, don’t worry, there are plenty of things you can do to improve it. Start by paying all of your bills on time, keeping your credit card balances low, and only applying for new credit when you need it.

Repair Your Credit

If you have negative items on your credit report, like late payments or collections accounts, it’s important to take steps to repair your credit. This will not only improve your chances of being approved for a new credit card, but it will also help you save money on interest and fees in the long run.

There are a few different ways to repair your credit, but the most effective method is to work with a professional credit repair company. Credit repair companies can help you remove negative items from your credit report and improve your credit score.

If you’re not sure whether you want to hire a credit repair company or try to repair your credit on your own, we’ve put together a list of the best credit repair companies to help you decide.

Obtain a Retail Store Card

If you’ve been denied for a traditional credit card, one option you have is to apply for a retail store card. These cards are easier to qualify for because they typically don’t require a good or excellent credit score.

Retail store cards can be used anywhere that accepts the particular retailer’s credit card. However, they usually come with high-interest rates and fees, so it’s important to use them wisely.

If you’re thinking about applying for a retail store card, we’ve put together a list of the best retail store cards to help you choose the right one for you.

Get a Credit Card with Secured Terms

Another option for people with bad or limited credit is to get a secured credit card. Secured cards are backed by a security deposit, which means they’re much easier to qualify for than traditional unsecured cards.

However, secured cards often have high fees and low limits, so it’s important to compare your options before you apply.

If you’re thinking about getting a secured credit card, we’ve put together a list of the best-secured credit cards to help you choose the right one for you.

Conclusion

If your credit card application has been denied, don’t despair, there are plenty of things you can do to improve your chances of being approved next time. Start by reviewing your credit report and credit score, and taking steps to repair your credit if necessary. You can also apply for a retail store card or secured credit card if you’re having trouble qualifying for a traditional unsecured card.

Do you have any tips for improving your chances of being approved for a new credit card? Let us know in the comments below!