If you have a history of paying bills late or are weighed down by debt, your credit score may not be where you want it to be. It’s not a great place to be and we understand how you feel.

Having a poor credit can be a frustrating hindrance, especially when it comes to convincing lenders of your ability to repay them.

Getting a personal loan can be helpful when handling unexpected expenses or clearing debt, but with a low credit score, you’re bound for higher interest rates or no loans at all. However, you can still obtain a personal loan with poor credit by taking informed steps to improve your score or comparing options from multiple lenders.

This article will provide you some tested and trusted tips on how to secure an online loan for bad credit and create better financial leverage for yourself. So let’s begin.

What Does a Poor Credit Really Mean?

Before we dive right into tips on getting loans with bad credit, we need to clarify what it means to have a “poor” credit or “bad” credit.

For starters, in nations like the United States, nearly every American has a credit record maintained by different credit bureaus. These credit records are used to calculate a credit score, which gauges and monitors how competent you are as a borrower.

So, what is this credit score?

A credit score is a numerical representation of your creditworthiness or loan value. It is affected by several factors including your payment history, outstanding debt, and credit utilisation. A credit score of 700 or above is classified as good, while a score of 670 or below is considered bad or poor.

So, if you have a history of late payments, high levels of debt, or a limited credit history, your credit score may be lower than you would like it to be. When you often have one or a combination of these negative factors, your score will likely fall below the 670 mark, and be considered as “bad” or “poor.”

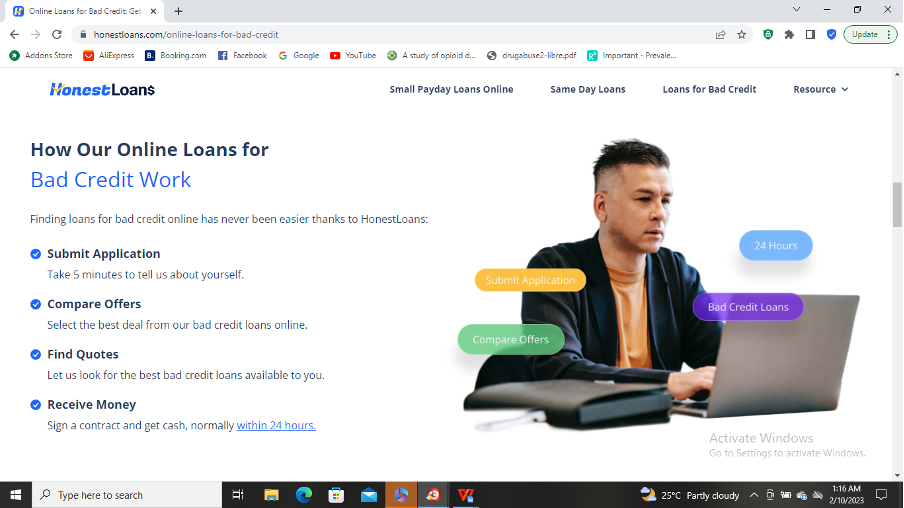

Online loan platforms consider these credit scores to give you various loan forms. The lower your score, the lower your chances of securing a favourable loan. However, a few platforms like Honest Loans, are experienced in providing good lenders for individuals with bad credit scores. Read more about Honest Loans.

Tips for Securing Favourable Online Loans for Bad Credit

Bad credit can be a major obstacle when it comes to obtaining a loan. This is simply because a low credit score is often considered an indicator of high risk lenders. Despite this, there are tips to increase your chances of getting a loan, even with a less-than-perfect credit score. Here are some of them.

- Understand “bad credit” and work towards good scores

This may seem like a forgone decision, but it usually takes nearly the same effort you need to secure a loan with your already poor credit score.

Once you’re fully aware of and understand your credit score and what factors contribute to it, you can start taking steps to improve it.

One of the best ways to improve your credit score is to pay your bills on time and to keep your debt levels low. You should also try to avoid opening too many new credit accounts simultaneously, as it can harm your credit score.

Nevertheless, we understand that your need for money may be time sensitive, and in such cases, you may not have enough time to up your credit scores. In such scenarios, you would need a faster method of approach.

- Research the best online loan options before choosing a lender or third-party lender

In addition to improving your credit score, shopping for the best loan option is another crucial step in getting a loan with bad credit. Many online lenders specialise in providing loans to individuals with bad credit. You can find intermediaries such as Honest Loans to help you find them.

It’s always crucial to compare rates and terms from multiple lenders to find the best loan option for your specific needs. It may prove a hard job at first, but you will eventually see a lender just right for you.

- Try personal loans

One type of loan that can be especially helpful for individuals with bad credit is a personal loan. Personal loans are unsecured loans that can be used for various purposes, including paying off debt, covering unexpected expenses, or making a large purchase. Unlike secured loans, personal loans do not require collateral, making them a more accessible option for those with bad credit.

When it comes to obtaining a personal loan with bad credit, it’s essential to understand that you may face higher interest rates and fees than those with good credit. However, this does not mean you should give up on your search for a loan.

Many online lenders specialise in providing personal loans to individuals with bad credit. So, you can compare rates and terms from multiple lenders to find the best option for your needs.

- If you have valuable assets use a secured loan

Another option for individuals with bad credit is a secured loan. Secured loans are loans supported by valuable collateral, such as a car or a house. These loans can be a good option for individuals with bad credit, as they often come with lower interest rates and more favourable terms. However, it’s crucial to understand that if you default on a secured loan, the lender can seize the collateral to recoup their losses.

- Avoid predatory lenders

When getting a loan with bad credit, it’s also important to be mindful of predatory lenders. Predatory lenders are lenders who offer loans with high-interest rates, hidden fees, and unfavourable terms to take advantage of individuals who are in a vulnerable financial position. It’s important to do your research to ensure you are working with a reputable lender to avoid falling victim to these types of lenders.

In Conclusion

Obtaining a loan with bad credit sounds difficult at first, but with the right steps, it is pretty doable. It is essential to understand what poor credit means and work towards improving your credit score. Also, compare different loan options and interest rates to get a good deal while searching for poor lenders. By following these guidelines, your next loan attempt should yield favourable results.