With the passing of each year, more and more people complain against collection agencies. Indicatively, the Consumer Financial Protection Bureau has handled approximately 542,300 consumer complaints in 2020, 58% of which concern credit and consumer reporting, including 15% of complaints accounted for debt collection.

Additionally, you may find a decent number of debt collection complaints across other channels and review websites like PissedConsumer.com or BBB.org. Consumers reported being contacted for debts that did not belong to them, having their accounts forwarded to third-party collectors without being informed first or giving consent, or receiving repeated calls many times within a day, even when at work.

If you find yourself portrayed in these lines, read on to learn how to protect your privacy and rights against debt collection agencies that cross the line and how to report an abusive debt collector.

Legal & Illegal Debt Collection Methods

According to the FDCPA, debt collectors can call you only between 8 a.m. and 9 p.m. (your local time). They also have the right to call you several times within a day, especially if you are avoiding their phone calls. What is NOT allowed, though, is to receive back-to-back calls from them as a means to irritate you or make you angry.

If you repeatedly disregard their calls, they can call your neighbors or friends to find out whether they have the right contact details for you. So far, this is legal. Nevertheless, they can only contact the same person ONCE and CANNOT reveal that they are trying to reach you to collect debt.

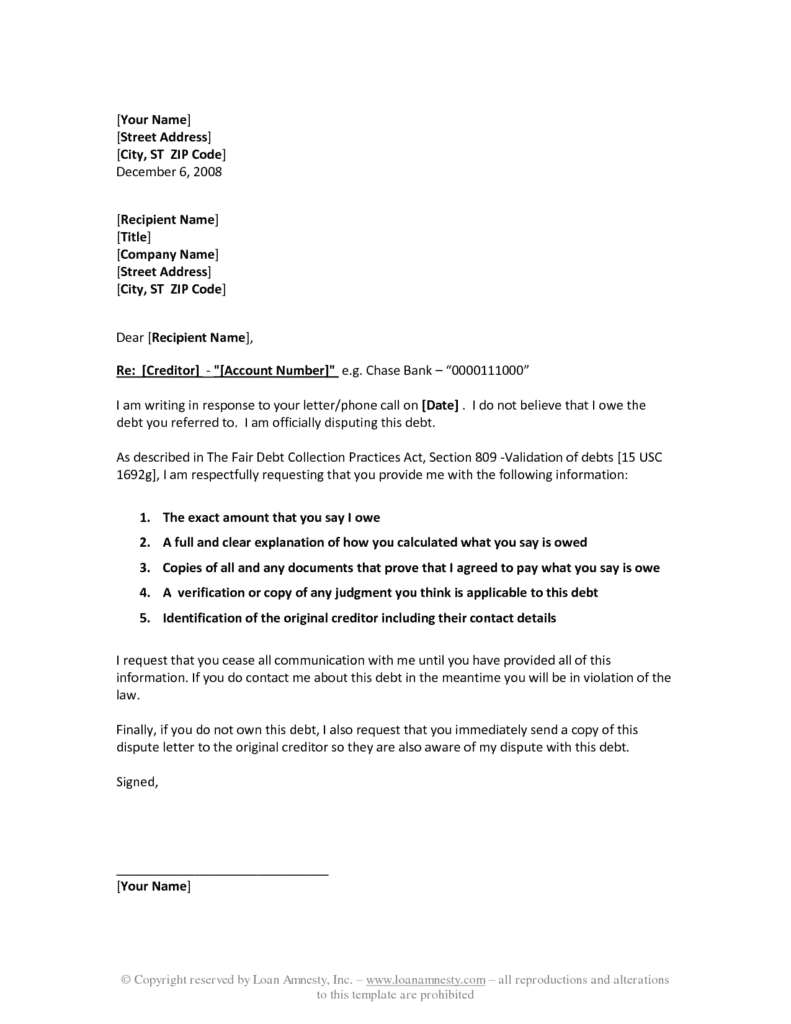

In the first bill you receive from them (the payment notice), they have to notify you that you have 30 days to request proof that you indeed owe the debt. This is called a debt validation request notice (see sample below) and can be provided to you either via mail or phone, depending on which method the collector is using to contact you during their FIRST attempt to collect the debt. In cases where collectors don’t have the correct address and phone number, chances are you will miss receiving that notice. After several months, you will see the debt listed on your credit report, as mentioned above.

How to Stop Debt Collectors from Calling Me

Know your Rights

The FDCPs clearly outline what debt collectors can and cannot do. They CANNOT:

- Call you without identifying themselves.

- Neither use violence (nor threaten to use violence) nor other criminal means to harm your property, reputation or you, nor claim they have the authority to harm you in any way.

- Use profane or obscene language.

- Use language in an attempt to abuse you.

- Embarrass you publicly to pay the debt (meaning, they cannot “Out” you about your debt or inform your neighbors/friends/boss that they are trying to reach you in regards to a debt).

- Contact you at work if this could affect your employment.

- Contact you at inconvenient times (see above).

- Call you repeatedly to harass, abuse or annoy you.

- Imply they are attorneys or contacting you from an attorney’s office.

- Threaten you with jail time for unpaid debt.

Also, the collector should send you a written “validation notice” (see above) within 5 days after they first contact you. This notice will tell you how much you owe them and will include a statement that the debt is assumed valid (unless you dispute it within 30 days after you receive the notice), a statement that the collector is obliged to provide you with any information you may need within 30 days, and the name of the creditor asking for repayment.

Take Notes

Even if a debt collector is not acting overly disrespectful or cursing, they may still be breaking the law, especially if they veil threats about letting others know about your debt, seizing your assets or garnishing your wages.

So, before you answer that call, make sure you have everything you need to jot down notes on the call (i.e. use your smartphone’s notepad or classic pen and paper). Keep records of your communications with the debt collection agency and the collector in case you need to sue the collector or file a complaint.

Dispute the Debt

If you believe that the debt is not yours, you have every right to dispute the validity of the debt. Contact the collector and notify them or, even better, make this request in writing. When they receive your dispute, they have to send you proof of the debt so they can resume the debt collection process. If they are unable to do so, they must stop contacting you.

Hire an Attorney

If the debt collector has caused you stress or trauma that has affected your employment or your ability to work or your health (medical bills will prove that), you may hire an attorney to help identify any illegal methods the collector may have used against you. It is legal to report a debt collector that has violated your rights. The attorney will make sure the abusive debt collector faces the consequences of breaking the law, especially if you have taken good notes of all your communication with them.

- Report to the authorities

You can file a complaint against collection agencies that use rude and abusive methods to collect debt. You may report a debt collector to the FTC or the CFPB (see below). If they gather a specific amount of complaints about a particular collector, chances are they will take legal action against the debt collection agency. Regardless of the final outcome, every abusive debt collector that shows disrespect towards the pertaining laws, should be held accountable for their actions.

Other things to do if you are experiencing harassment by collection agencies:

- Keep yourself together and don’t lose your temper. Getting angry will not stop the collector from calling you again.

- Don’t try to get the collector to feel your financial struggles and show sympathy. Their job is to force you to repay the debt, one way or another.

- Hang up the phone if you feel that the conversation is becoming too uncomfortable to handle (i.e. abusive language or threats).

How to Report Debt Collector Violations

The State Court

You can complain against collection agencies that violate the law when dealing with you by reporting them to your state’s attorney general’s office. Also, you can sue an abusive debt collector that has failed to abide by the federal rules. Most of the time, they will be forced to pay for the damage incurred (if it is a class action lawsuit, the collection agency will need to pay the lesser of 1% of their net worth or $500,000). If you take your case to state court and win, you might also be awarded $1,000 in statutory damages. Just make sure you take such legal action within one calendar year from the date you have filed the violation report.

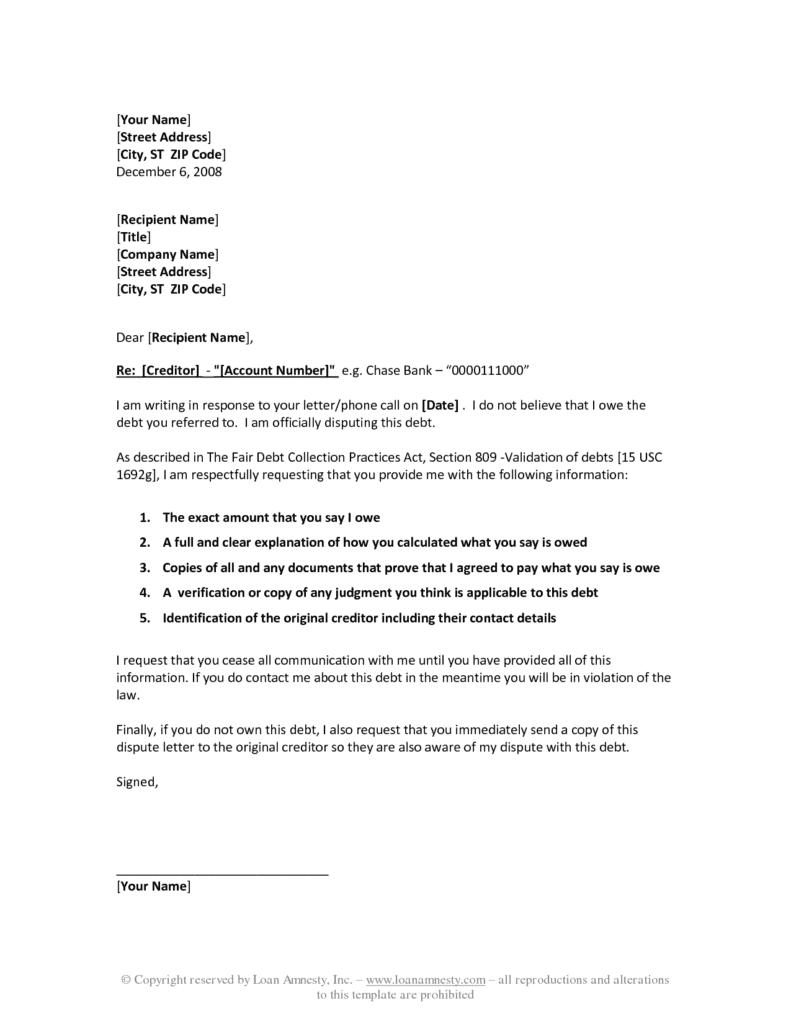

Cease and Desist Letter

If the debt collector is calling you over a debt repeatedly, you may dispute the debt and send the collector a cease and desist letter (see sample below). This actually lets them know that they can no longer contact you (not legally, at least). These letters are also referred to as drop-dead-letters, for obvious reasons!

The Federal Trade Commission

You may report a debt collector that violates your rights or instances you have experienced harassment by collection agencies to the Federal Trade Commission by calling 877-382-4357, sending them a letter at:

Consumer Response Center, 600 Pensylvannia Ave.,

NW Washington, DC 20580,

or visiting the FTC Complaint Assistant page.

Consumer Financial Protection Bureau

Report a debt collector that breaks the law by submitting a complaint with the Consumer Financial Protection Bureau against that collector. The Bureau will investigate your case and penalize the collector for violating your rights and the FDPCA, especially if they have received many complaints about that particular collector. On their website, you will also find sample letters that will help you send debt collectors the right letter per your case (i.e. for debt that is not yours, ask them to stop contacting you, etc.).

Final Notes:

- If your debt is older than 4 years, it is highly likely that the credit reporting time and statute of limitations have expired. In this case, you don’t have to pay the debt. However, it is a moral obligation one needs to take into great consideration as repaying a debt is the right thing to do.

- It is wise to remove the collection from your credit report to improve your credit score. If you manage to get the collector to remove the entry, ensure you get everything in writing.

Collecting debt should be handled in accordance to pertaining laws and always with due respect towards your privacy and reputation. It is your legal right to report a debt collector or debt collection agency that uses abusive or illegal methods to make you repay your debt. Luckily, there are several ways to protect yourself and claim your rights, provided you know exactly what these are.