What is Term Insurance?

Term insurance is a type of life insurance that provides coverage for a certain period of time, or a “term.” Upon the demise of the policyholder during the term of the policy, while the policy is in force, the death benefit is paid to the nominee. There are no maturity benefits (this is unless it is a TROP plan) on surviving the policy term.

The reason term plans can be bought at such a low cost is that the premium that you pay while buying a plan goes entirely to cover the risk of mortality, no part of which is invested by the insurance company.

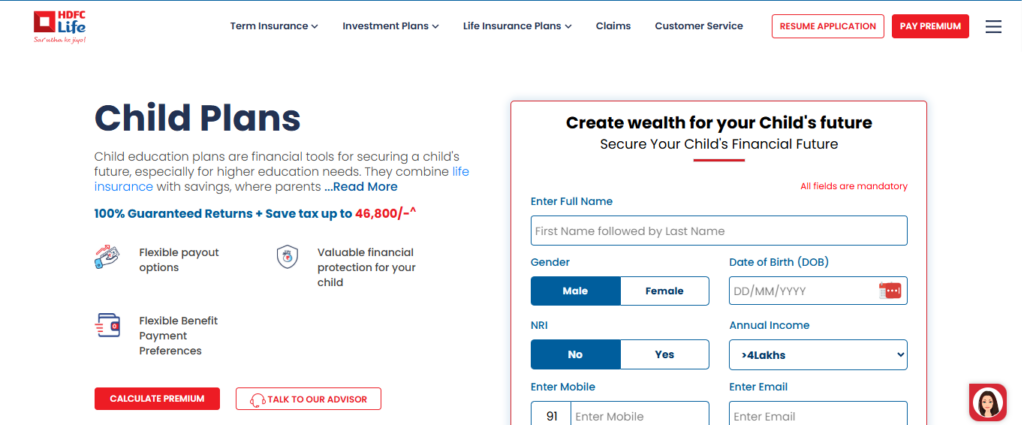

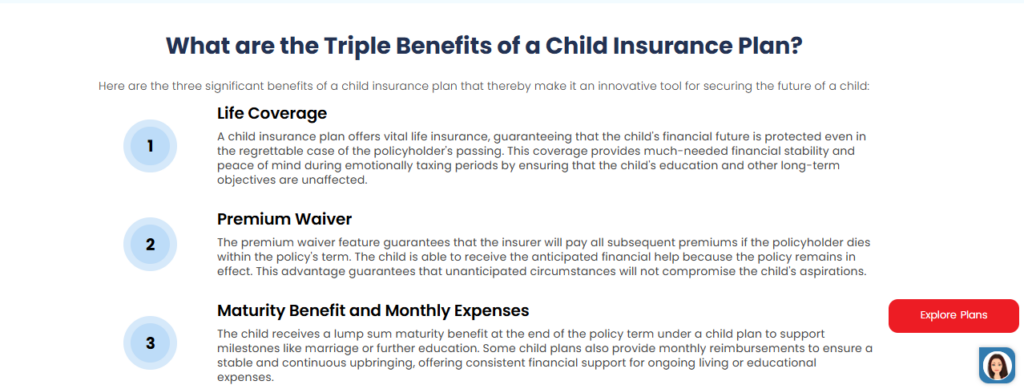

While term insurance is not a traditional investment or savings tool, it is a pure protection product, making it a perfect complement to other instruments like the best child insurance plan, which aims to secure your child’s future milestones like education or marriage.

Who Should Buy a Term Plan?

Term insurance is ideal for a wide variety of individuals:

1. Young Professionals

Starting early allows individuals to lock in low premiums. The earlier you buy, the cheaper the plan, making it a wise financial decision at the beginning of one’s career.

2. Married Couples

A term plan acts as a financial support to your spouse. This helps to secure their future financially from unforeseen circumstances and also maintains peace in your absence.

3. Parents

Term insurance becomes essential for parents who want to combine it with a child saving plan to ensure their child’s dreams, education, and lifestyle are not compromised due to any unforeseen loss.

4. Self-Employed Individuals

Individuals with erratic flow of income, a term plan takes care of your loan repayments or family expenditure in the event of the breadwinner’s absence.

5. Taxpayers

Term insurance offers tax benefits under Section 80C and Section 10(10D) of the Income Tax Act, which means it is a smart tax planning instrument.

6. Non-Resident Indians (NRIs)

NRIs can purchase term plans in India for the financial security of their families. There are a number of Indian insurers offering NRI-friendly term insurance plans, with many of them having feature-rich offerings along with tax benefits.

Tactics Followed by Insurance Adjusters to Lowball Victims

Benefits of Term Insurance Plans

Term insurance plans are not just about death benefits. Here’s a deeper look at the array of advantages they offer:

Financial Security for Your Family

Term insurance ensures your family’s financial needs, like rent, food, education, and other expenses, are taken care of after your demise.

Asset Protection

Loan repayments, such as home, personal, or education loans, can become a burden on your family. Term insurance helps settle these liabilities, protecting your assets.

Lifestyle Risk Coverage

Many term plans offer critical illness coverage, which provides a lump sum amount upon diagnosis of severe diseases like cancer or a heart attack, helping manage high treatment costs.

Affordable Premiums

As a pure protection plan, term insurance is one of the most economical life insurance options. High sum assured can be secured at low premiums, especially when bought early.

Income Replacement

The death benefit acts as a replacement for the deceased’s income, helping the family continue to meet regular expenses and long-term goals.

Tax Benefits

- Section 80C: Premiums up to ₹1.5 lakh are tax-deductible.

- Section 10(10D): Death benefit is tax-free in the hands of the nominee (subject to prescribed conditions).

Why Your Car Insurance Rates May Be Higher Than Expected

Customizable Coverage through Riders

Add-on riders enhance coverage:

- Accidental Death Benefit

- Accidental Disability

- Critical Illness

- Waiver of Premium

- Terminal Illness

Types of Term Insurance Plans in India

Various term plans are available in the market to suit the diverse needs of individuals:

1. Basic Term Plan

Offers pure life cover with no return of premium. If the insured dies during the term, the nominee receives the death benefit. Ideal for those seeking simple and affordable life insurance.

2. Level Term Insurance

The sum assured remains constant throughout the term. It offers predictable and consistent protection for long-term financial planning.

3. Increasing Term Insurance

The sum assured increases each year, typically by a fixed percentage. This option helps counter inflation and rising costs.

4. Decreasing Term Insurance

The sum assured decreases over time. Useful for covering decreasing liabilities such as home loans or business loans.

5. Term Plan with Return of Premium (TROP)

If the policyholder survives the term, all premiums (excluding taxes and rider charges) are returned. Suitable for individuals who want some form of maturity benefit.

6. Convertible Term Insurance

This type of term insurance can be converted into a permanent life insurance plan, such as an endowment or whole life policy, in the future, without a fresh medical examination.

7. NRI Term Insurance

Specifically designed for NRIs, these policies provide life cover in India while the policyholder resides abroad. Most leading insurers offer these plans with digital onboarding and simplified documentation.

8. Group Term Life Insurance

These are employer-provided policies covering multiple employees under a single plan. While cost-effective, these may offer limited coverage and often cease when the employment ends.

How is Incurred Claim Ratio Different From Settlement Claim Ratio?

Real-Life Examples of Term Insurance Plans

Example 1: Term Insurance without Return of Premium

Mr. A purchases a basic term insurance plan from PNB MetLife. If he passes away during the policy term, his nominee receives the sum assured. If he survives the term, no benefits are paid out. He chooses riders like critical illness and accidental disability to enhance protection.

Example 2: Term Insurance with Return of Premium

Mrs. B opts for a TROP plan. She gets the same benefits as Mr. A, including the option to add riders. However, if she survives the policy term, she receives back the total premium paid, ensuring she doesn’t lose the investment.

These examples show the core functionality of term insurance and how the right plan can be tailored to meet individual preferences and financial goals.

Conclusion

For anyone with dependents, term insurance is the cornerstone of financial planning. It gives you peace of mind that your loved ones are not financially strained when you die. Whether you want loan-enabled options, you’re looking for flexible riders, or you simply need affordable premiums, term insurance is one of the best ways to protect your family’s future.

No matter if you are at the beginning of your career or are busy bringing up your family, if you own a business or are working overseas, having a term plan should become an integral part of your overall financial plan.