Everyone dreams of the day they become a homeowner. This is a massive adulting milestone, just like the first time you moved out of your parents’ home to start a life alone. However, along with the decision to buy your own home comes numerous responsibilities, loans, and lifestyle changes.

You need to be thorough with every document and process involved in buying a home and make sure you research and read through every word there is. Do not settle on the first lender or the realtor that you find. Ask as many questions as you possibly can and make sure you understand every detail in the fine print.

Doing these will help you make an informed decision. The last thing you want is to have bad memories or experiences around buying your dream home. So, make sure you follow these tips to ensure that you have an easy time buying a home and adjusting to the new life after that.

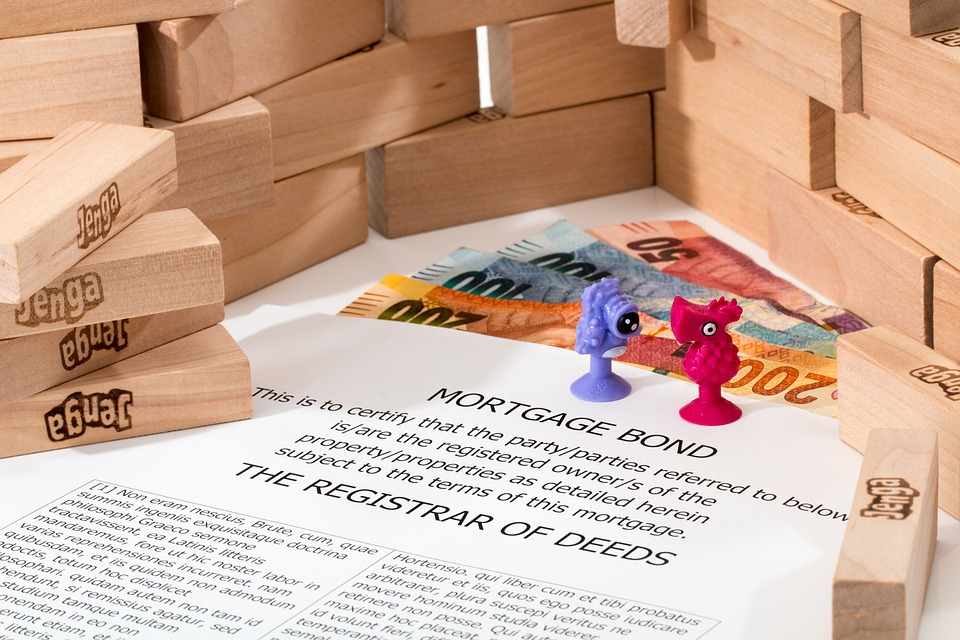

Understand The Mortgages

Taking a mortgage makes homeownership easy. You can buy a home that is outside your budget with help from banks and lenders. But, it is important to note that these loans need to be repaid on time. If you are taking a mortgage, it is important to understand that non-repayment or missing payments could mean losing your home.

So, before you pick a mortgage, make sure you have read the fine print, the repayment terms, and the closing charges. It will help if you use a mortgage loan calculator to understand the monthly EMI that you need to pay. That way, there will be no surprises when you have to start the repayment cycle. Understanding your EMI before you take a loan will help you figure out your finances for other loans, bills, and necessities. While buying a home is important, it is important to ensure you do not go bankrupt in the process. So, secure your finances and have some emergency funds and savings before you invest in a home.

Cut Down Expenses

Buying a home is not an impulsive decision, and you see it coming. So, start saving money for your EMI as soon as you decide on buying a home, even before you go house hunting.

You could use part of your savings for a downpayment while getting most of it from the loan. The rest of the money that you put into savings should help you pay your EMIs for a few months. And during this period, you need to start saving with the help of different investment plans. Another way to save money is to look for a VA loan, though these are for the military only. However, there are ways to pay 0 down this way, you can find more info about these in this post from Security America Mortgage.

Remember, you should never leave all your eggs in the same basket, more so, with a home loan waiting for you to repay. It will also help if you understand the futile spendings that you make and stop it.

For instance, it might seem like nothing to buy your coffee every day. However, the annual average could come to something around £303 per person. If you consume the same coffee at home, you will save a fortune, and this money could go into some legitimate expenses. The same holds true for takeouts vs. cooking at home. When pooled in together, the minor savings that you make could make a major difference to your financial health.

Tax Benefits

Home loan repayment includes the interest rate besides the mortgage amount. That qualifies under deductibles while filing for taxes. While filing your taxes, remember to include this in the deductibles section to reap maximum benefit out of your mortgage. As the loan tenure is usually for five to thirty years, you would save a fortune on the tax deductibles on the interest rate. Make sure you talk to your financial advisor about this while filing your taxes.

Explore Prepayment Options

Your earning capacity is going to increase over the tenure of your loan, and you might even land a high-paying job. It would be best if you could use these opportunities to pre-pay a significant amount of your loan. When you prepay the loan, you would cut down on the monthly EMI and land a lower interest rate. Put to good use the money you get from your career advancements by paying back your loan. Doing this could mean that you can own the home completely without any mortgage sooner than when you set out to buy the property.

Consolidate Your Loans

You might have borrowed money for other life emergencies in the past and could be repaying them while applying for a home loan. It could seem manageable, but the increasing EMIs and the high-interest rate could make life difficult for you. So, take the help of a debt consolidation agent and consolidate your loans to one loan with a lower rate of interest.

You would now have only one low-interest loan to deal with, and that saves you a lot of money to pay for the home loan. Besides that, make a conscious decision to cut down your spendings using your credit card because the interest rate on credit cards is relatively higher. But it could take your finances out of your control and leave you in a pool of debts. So, avoid using your credit cards unless absolutely necessary. While you apply for debt consolidation, remember to not close your credit cards in an attempt to avoid spending. This would remove all history of your spending from your credit report and could impact your credit health. So, avoid spending, move your debts to one with a low-interest rate, and never skip a payment.

Following these tips could be a bit difficult in the initial stages. But as the months go by, you would get into the habit of spending less and saving more. The burden of the mortgage would not be so high as your expenses will come down, and you will have a relatively healthy and happy life. The journey could be tough, but the destination of being a homeowner with no debts is rewarding.